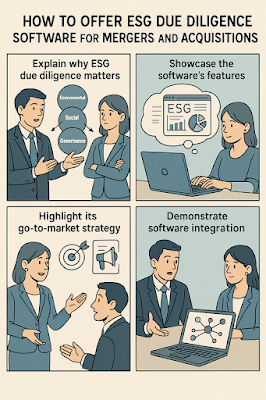

How to Offer ESG Due Diligence Software for Mergers and Acquisitions

Environmental, Social, and Governance (ESG) considerations have become central in mergers and acquisitions (M&A) deals worldwide.

As companies prioritize sustainability, offering ESG due diligence software can give your business a competitive edge in the M&A space.

This post will guide you through the steps to successfully develop, market, and deliver ESG due diligence software to corporate clients.

Table of Contents

- Why ESG Due Diligence Matters in M&A

- Key Features of ESG Due Diligence Software

- Effective Go-to-Market Strategies

- Integration with M&A Workflows

- External Resources and Tools

Why ESG Due Diligence Matters in M&A

Investors and acquirers are increasingly aware that ESG risks can impact the financial performance and reputation of a deal.

From carbon emissions to labor practices, ESG factors can make or break an acquisition.

Regulators, too, are stepping in with guidelines that demand more transparency during M&A processes.

ESG due diligence software helps companies assess these risks early, avoiding surprises after closing.

Key Features of ESG Due Diligence Software

Strong ESG software must offer automated data collection, real-time scoring, customizable reporting, and benchmarking tools.

It should aggregate data from internal systems, third-party ESG databases, and regulatory sources.

Natural language processing (NLP) can help analyze ESG reports, media sentiment, and regulatory filings.

Dashboards should be intuitive, enabling teams to visualize ESG risks at a glance.

Effective Go-to-Market Strategies

Target private equity firms, investment banks, and corporate development teams who lead M&A deals.

Highlight how your software reduces due diligence time and improves decision-making quality.

Offer free trials or pilot programs to demonstrate value early.

Use thought leadership content—like webinars, whitepapers, and case studies—to establish authority in the ESG space.

Integration with M&A Workflows

Seamless integration with virtual data rooms (VDRs), contract management systems, and compliance tools is critical.

APIs and modular architecture allow for smooth connections with tools already used by M&A professionals.

Ensure robust data security and compliance, as ESG assessments often involve sensitive company information.

Offer tailored onboarding and support to help clients adopt the platform quickly.

External Resources and Tools

Staying updated with ESG standards and frameworks will strengthen your software offering.

Here are some helpful external resources:

Offering ESG due diligence software is no longer optional—it’s an essential part of modern M&A transactions.

By focusing on automation, robust analytics, and seamless integration, your software can help clients navigate complex deals with confidence.

Stay ahead by aligning your product roadmap with evolving ESG regulations and client expectations.

Keywords: ESG software, M&A due diligence, sustainability tools, compliance integration, risk management

Discover the latest breakthroughs in health.

Master time management for busy professionals.

Learn smart saving strategies for your future.

Explore innovative marketing techniques.