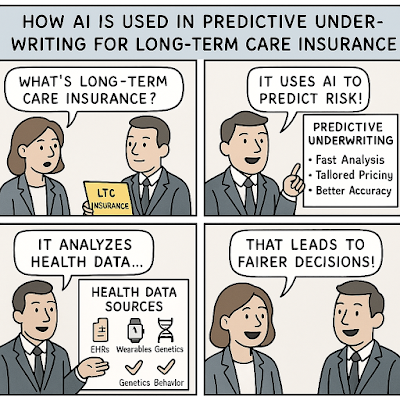

How AI is Used in Predictive Underwriting for Long-Term Care Insurance

As populations age and healthcare costs rise, long-term care (LTC) insurance becomes a vital yet complex product to underwrite.

Traditional underwriting involves time-consuming medical exams and subjective assessments.

Now, artificial intelligence (AI) is revolutionizing LTC underwriting by predicting future care needs based on data—not just diagnosis.

📌 Table of Contents

- What Is Long-Term Care Insurance?

- How AI Enhances Underwriting Accuracy

- Data Sources Used in AI Modeling

- Benefits and Ethical Considerations

- Explore More: Related Insights

What Is Long-Term Care Insurance?

Long-term care insurance helps cover services like in-home assistance, assisted living, and nursing home care when individuals can no longer perform basic daily activities.

Unlike health insurance, LTC insurance focuses on extended care needs often triggered by aging, chronic illness, or disability.

Underwriting these policies requires estimating the likelihood of future dependency and cost exposure.

How AI Enhances Underwriting Accuracy

AI models analyze structured and unstructured data to assess risk faster and more accurately than traditional methods.

Algorithms use historical claims, biometric data, and lifestyle indicators to predict long-term care usage.

Predictive analytics allow insurers to approve applications in minutes, customize premiums, and reduce adverse selection.

Data Sources Used in AI Modeling

- Electronic Health Records (EHRs)

- Wearable devices (e.g., step count, sleep patterns)

- Genetic testing data (when permitted)

- Prescription history and medication adherence

- Socioeconomic and behavioral data (e.g., social isolation)

Benefits and Ethical Considerations

Benefits:

- Faster underwriting decisions

- Personalized premium pricing

- Lower administrative costs

- Expanded access for underserved applicants

Ethical Issues:

- Risk of algorithmic bias (e.g., race, income)

- Data privacy and consent concerns

- Overreliance on non-medical lifestyle indicators

Regulatory frameworks are evolving to ensure fairness and explainability in AI models used for underwriting.

Explore More: Related Insights

Explore these related resources to understand the intersection of AI and insurance underwriting:

Important keywords: AI underwriting, long-term care insurance, predictive analytics, health data, insurtech